This is NOT a bill?! Well, it looks like one

How to read your EOB (Explanation of Benefits) without losing your mind

You’ve made an appointment, checked in, saw the doctor, gave some blood, and walked out, done right?

Not quite.

A few weeks (or sometimes months later, a mysterious piece of mail arrives from your insurance company. It has your name, your doctor's name, and a bunch of numbers. It may say something reassuring like “This is not a bill”, but it looks exactly like…. well, a bill.

Let’s be real, this paperwork wasn’t designed to be understood without caffeine and a support group.

The EOB, or Explanation of Benefits, is a confusing and misleading document in healthcare. But also a very important one.

Let’s make some sense of this.

What is an EOB (Explanation of Benefits)

An EOB is a summary sent by your health insurance (the payer) after you have received care by a provider (remember, this can be a person, place, or thing).

The EOB explains:

What was billed by the provider

What the insurance paid (if anything)

What discounts or adjustments were applied

What you (the patient) might still owe

Think of this as both a receipt and a status update from the insurance company. This is not a demand for payment (remember, the bill comes from your provider office), but a way to show what the insurance company has received and what the status of the claim is with the insurance (payer).

The EOB is from your insurance, not your doctor or hospital and is a snapshot of how your claim was processed. You should review it before you pull out your wallet.

Where the EOB Fits in the Claim Process

Remember the claim flow we discussed in Your Claims Post Visit Adventure?

Here is a quick visual refresher, with a star marking where the EOB shows up.

The EOB may arrive AFTER your insurance has reviewed the claim and made a payment decision, but BEFORE your final bill hits your mailbox.

How to Read it (Breaking it all Down)

If you’ve ever looked at one of these and thought, “What the heck am I looking at?” I hear you! This is where understanding the terms, definitions, and vocabulary can really help you. You don’t have to be a pro, just a little curious.

☕ Grab your coffee (or tea 🙂), I’m the support group. Let’s go!

Real Life Example EOB’s

In this real-life example, I had an appointment with my doctor, during which an office visit and examination were performed, as well as blood work ordered and drawn during the visit. These procedures were coded on the claim and sent to the insurance company.

Note, the doctor visit and lab work were on two separate claims; therefore, I received two EOB’s.

📌 Please note, this is a real EOB from my personal healthcare experience, shared to help others understand how to read these confusing documents. I’ve removed or blurred identifying information such as the Claim ID, Member ID, and Provider Name to protect privacy. Your EOB might look a little different depending on your insurer, but most include the same key elements.

Doctor Visit EOB

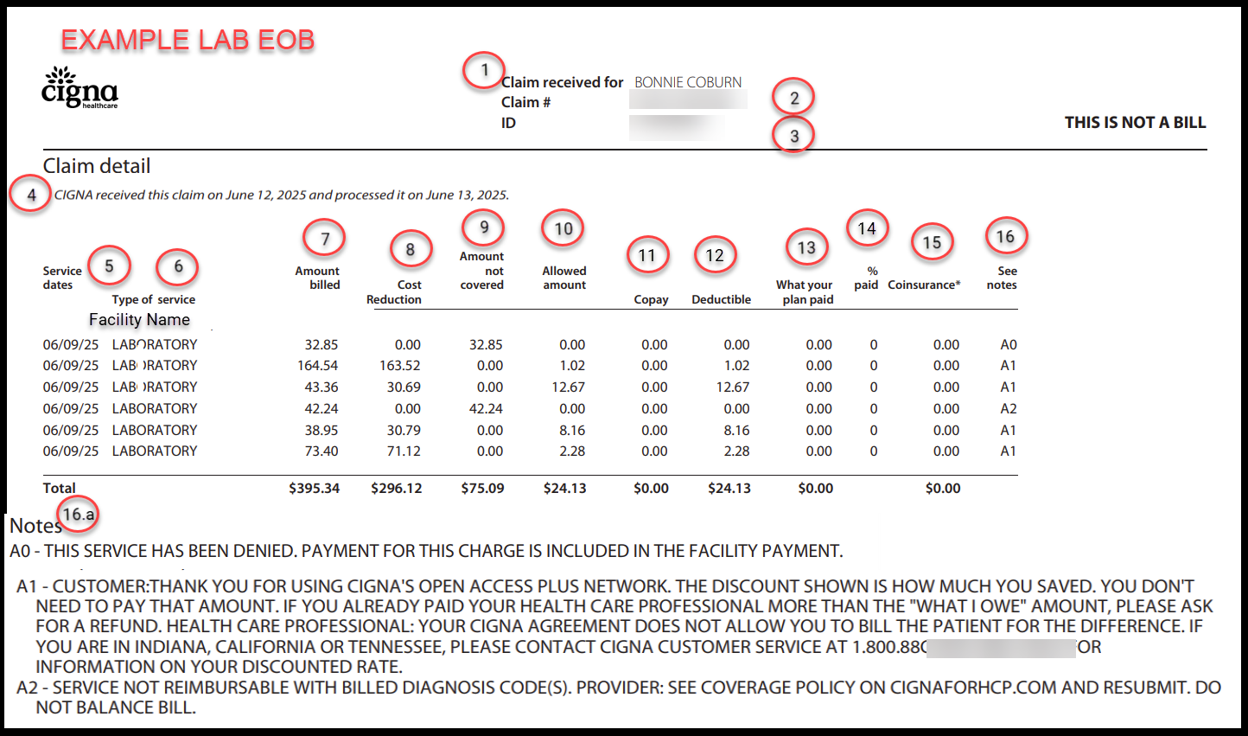

Lab Visit EOB

Note: These EOBs are shared for educational purposes only. This content is not affiliated with, endorsed by, or reviewed by Cigna.

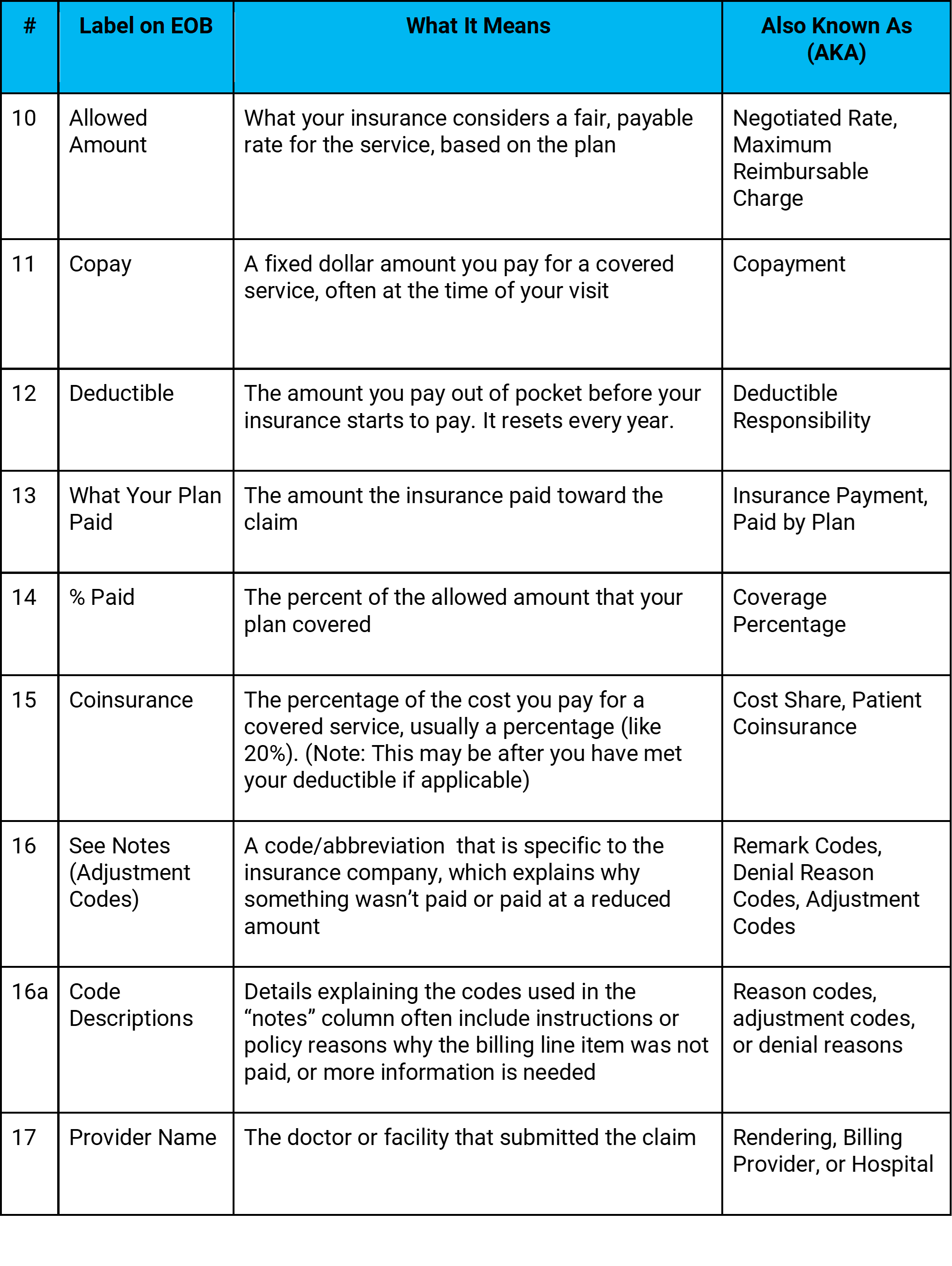

What do the fields on the EOB mean?

💡 Pro Tip: The reason codes or notes are often abbreviated and can be difficult to interpret. But most insurance companies include a glossary on the back of the EOB or online. Use it!

These codes can be the key to understanding billing mistakes, rejected procedures, or even services that should’ve been covered. Knowing what they mean (or where to find the definition) can save you from overpaying or from letting a correctable error slip through the cracks.

💬 Still Confused? Some of these definitions may still feel a little confusing, and that’s okay. We’ll dive deeper into these terms (such as deductibles, coinsurance, denial codes, and other medical billing and coding concepts) in upcoming blog posts.

➡️ If you’d like a copy of the handout I shared during the webinar, which includes easy explanations of many common healthcare terms, feel free to reach out. I’m happy to share it!

So What Happened in This EOB?

The visit with my doctor was on Jun 9, 2025, and I had an office visit with my physician, during which blood was drawn for lab tests.

Let’s walk through how the insurance company processed the two claims and what it meant for my wallet.

🩺 DOCTOR VISIT EOB

The doctor visit claim had the billed items for the evaluation by the provider. Let’s walk through what happened on this claim.

Service Date: 6/9/2025 - the date that I went to the doctor

Type of Service: Physician - this is the doctor's examination and visit

Amount Billed: $469.68 - total amount of charges from the provider

Cost Reduction: $36.68 - discount (cost reduction) is based on the negotiated rates between my insurance company and the doctor (Total Amount minus Allowed Amount). This is a benefit of going to an in-network provider.

Amount Not Covered: $50.00 - this is the amount denied or not covered; check the reason code for additional information

Copay: $0.00 - there was not a copay for this visit

Deductible: $383.00 - since I hadn’t met my yearly deductible yet, the insurance didn’t chip in, and the full allowed amount became my responsibility.

Allowed Amount: $383.00 (after discount) - the amount that is negotiated and agreed on between the insurance company and the network (contracted provider)

What Your Plan Paid: $0.00 - the amount is zero because my yearly deductible has not been met.

% Paid: 0% - the percent is zero because my annual deductible has not been met.

Coinsurance: $0.00 - this amount is zero because the deductible has not been met, and there is not an amount that would apply to coinsurance

What I Owe: $383.00 – because the amount was applied to my deductible. What I owe shows is the total billed amount, minus the discount, and the non-covered amount.

Reading the notes and the “reason” codes that provide additional information about the billed lines.

A0: I received a network discount (this is part of being an in-network provider), and I don’t owe that portion.

A1: One billed line (worth $50) was considered non-covered by the insurance.

(Side note: In working through this blog and example, I found the error and contacted the doctor's billing office, which ended up removing the $50 charge and rebilling 🙂)

🧪 LAB WORK EOB

The lab work was billed separately from the doctor visit and therefore had a separate EOB. Let’s walk through what happened there.

Service Date: 6/9/2025 - the date that I went to the doctor

Type of Service: Laboratory - this is the blood work

Amount Billed: $395.34 - total amount of charges from the provider

Cost Reduction: $296.12 - discount (cost reduction) is based on the negotiated rates between my insurance company and the doctor (Total Amount minus Allowed Amount). This is a benefit of going to an in-network provider.

Amount Not Covered: $75.09 - this is the amount denied or not covered, check the reason code for additional information

Copay: $0.00 - there was not a copay for this visit

Deductible: $24.13 - since I hadn’t met my yearly deductible yet, the insurance didn’t chip in, and the full allowed amount became my responsibility.

Allowed Amount: $24.13 (after discount) - the amount that is negotiated and agreed on between the insurance company and the network (contracted provider)

What Your Plan Paid: $0.00 - the amount is zero because my yearly deductible has not been met.

% Paid: 0% - the percent is zero because my annual deductible has not been met.

Coinsurance: $0.00 - this amount is zero because the deductible has not been met, and there is not an amount over that would apply to coinsurance

What I Owe: $24.13 – because the amount was applied to my deductible. What I owe shows is the total billed amount, minus the discount, and the non-covered amount.

Reading the notes and the “reason” codes that provide additional information about the billed lines.

A0: The $32.85 charge was denied, possibly because it was included in a facility fee (i.e., bundled).

Possible Action: I would first verify if I were being billed for this item. I would need to contact the insurance or doctor billing office to understand this, and if any corrections need to be made.

A1: I received a network discount (this is part of being an in-network provider), and I don’t owe that portion.

A2: One test was denied entirely due to diagnosis coding, not matching the insurance reimbursement policy.

Possible Action: I would first verify if I were being billed for this item. I would need to contact the insurance or doctor billing office to understand this, and if any corrections need to be made.

In summary, for both claims, I owe $407.13. The services were in-network, so discounts were applied, but I hadn’t met my deductible yet, so the insurance applied the amount to my deductible.

Tips for Troubleshooting

💡 Pro Tip: You can often find the exact procedure and diagnosis codes that were billed by logging into your provider portal (like MyChart). I found summaries under My Visits.

💡Additionally, under the billing and statements, I found the claim details information, which shows the procedure (CPT) codes that were coded on the claim and billed to the insurance. The detail helped me match the claim to the EOB and do some troubleshooting for next steps.

Why EOB’s Can Be Confusing

EOB’s are supposed to explain benefits, but that sometimes seems like an oxymoron, doesn’t it? They are confusing, but why?

They look like bills. Fonts, layouts, and itemized lines feel like invoices.

Bills can arrive first. Sometimes your doctor bills you before the EOB shows up.

Terminology on the EOB isn’t standardized. Different payers use different words on their EOB.

Payers use different systems to process the claims; these systems have different names for things, different notes, and different codes.

Adjustment and denial codes are cryptic.

Adjustment codes (i.e., reason codes, denial codes, notes) may have multiple descriptions tied to the same code; it’s important to read the details.

Service descriptions are in medical terminology. “Comprehensive metabolic panel” might not sound like “bloodwork.”

✅EOB Review Checklist: What To Look For

You’ve got an EOB, now what do you do with it? This simple checklist may help guide you in reading your EOB and make you feel more comfortable when you receive it from your insurance.

Is your name and birth date correct?

Is the date of service (when you were seen) correct?

Do the services listed match what you remember happening? (These are the procedure codes (e.g., CPT, HCPCS)

Review each billed line; they may have different details.

Is the provider listed correctly? (Remember, the provider can be a doctor, hospital, laboratory, or sometimes even equipment)

Is the provider in-network or out-of-network? (This may impact payment, and if a discount is applied)

Review what was paid on each billed line.

If nothing was paid, review the reason. (You can look up the adjustment or review codes or reference them.. If you’re not sure, call the insurance or doctor support number.

If payment was made, review the adjustments or discounts. (If a discount was not applied and you saw an in-network provider, this may indicate that the insurance company needs more information, or possibly an error in the billing.)

If an amount is owed (what you may owe), was it a co-pay, co-insurance, or deductible?

Compare the bill or detailed claim information from the doctor with the EOB information

📞 If something looks off:

Call your provider’s billing office

Or contact insurance member services

Start with: “Can you help me understand this?”

You don’t have to be an expert, just curious (and maybe a little persistent).

Why it matters?

Understanding your EOB helps you (the patient):

Avoid paying more than you owe

Catch errors before they continue or snowball

Ask better questions (and get better answers)

Feel more in control of your healthcare experience

For Teams (e.g., Product, Tech, Operations)

This is an opportunity to create better tools and ways to empower patients and improve internal systems. The more we simplify EOBs and claim experiences, the more we empower patients and reduce call center volume, confusion, and rework for everyone else in the system.

If you’re building tools for patients or integrating EOB data, consider:

Plain-English translations of denial and adjustment codes

Plain-English descriptions of procedures and diagnoses

Claim + Bill comparison tools (reporting, or other tools)

More detailed descriptions for status (color-coded statuses or filters: Paid / Pending / Denied)

Better claim tracking (if Amazon can tell us when socks ship...)

Downloadable spreadsheets or mobile-friendly summaries

And yes, AI (Artificial Intelligence) has its place too, but it should be trained by people who understand the complexities of healthcare. The real-world rules, workflows, and exceptions matter more than buzzwords and jargon.

Wrapping It Up: Confidence, Not Confusion

The goal is not to become a billing expert overnight but to feel more comfortable, more informed, and more in control of your healthcare. Whether you are a patient trying to understand a charge, or a team building tools for others, or someone caught in between, every morsel of clarity helps. And hey, if you made it through this blog, you’re already ahead of the game!

📚 Missed the earlier posts in this series?

Catch up here: https://coviewconsulting.substack.com/

Why I Started CoView: Navigating Both Sides of Healthcare

Speaking the Same Language in Healthcare

Meet the Players: Patient, Provider, Payer

Cracking the Code

Your Claims Post Visit Adventure

What’s Next: Wait, Who Pays for What? Medicare, Medicaid, and Commercial Insurance

You got the EOB. You cracked the codes. But now you’re staring at it thinking, Okay… but who actually pays for all this?

Is it Medicare? Medicaid? Your employer’s insurance?

(Definitely not your dog, even if they are on the family plan in your heart.)

Part 1 – Medicare & Medicaid: how they work, who they cover, and why they’re often confused.

Part 2 – Commercial Insurance: the “choose your own adventure” of healthcare coverage, and why your bill might look nothing like someone else’s for the same visit.

Thank you for being here,

Bonnie

💡 If this topic sparked questions or curiosity, I would love to hear from you!

We held a live webinar on this very subject: Speaking the Same Language in Healthcare.

➡️ If you missed it and would like the recording and handout, feel free to email me at bcoburn@coviewconsulting.com or send me a message on Substack or LinkedIn.

➡️ Interested in other webinars? Let me know!

Note from the Author: This series is not a prep course for medical coding exams. It’s designed to help cross-functional teams in the healthcare industry work together more effectively. The skills you'll learn will also empower you to be a more confident advocate for yourself and your loved ones in your personal healthcare matters.