Appealing Denied Claims

Become the Claims Whisperer

You’re watching a movie, and the hero has a setback, but with the right team, clever use of equipment, and perhaps a little persistence, they turn things around.

That’s what dealing with a claim denial can feel like, except instead of villains, you’re battling acronyms, strange terminology, and paperwork. With medical claims, the correct information (and a healthy dose of patience) can be your best superpower.

Last time, we talked about what a denial actually means. But knowing why your claim was denied is only half the story. The real question is: what can you do about it? That’s what this blog is for: think of it as a toolkit, a step-by-step, plain English guide with examples you can actually use.

In a nutshell, a denial means your insurance company has decided not to pay the claim the way it was sent to them (or submitted). It almost feels like the insurance company is saying, “Prove it.”

And you’re right, it doesn’t seem fair. You did the right things: went to your appointment, your provider billed, and the claim should be paid. Instead, you get stuck with homework you never asked for.

I’m not saying the system shouldn’t be different (it should, and there’s work to be done to influence change). But until then, my goal here is to help you deal with the reality right in front of you: how to respond to a denial and how to give your claim the best chance of being overturned, or at the very least, understand why it was denied.

Step 1: Decode the Denial

Rule #1: Don’t panic, just decode. Or, as a good friend of mine says, “Get curious, not furious.”

Although the denial codes may appear to be an alphabet soup, they are the key to understanding what happened.

Somewhere you’ll see a code (e.g., CO-16 or PR-204) and a short description…and suddenly we’re singing Mr. Roboto…. 🤖🎵

To most, it is a jumble of nonsense. But those codes are your clues on what is happening.

CO-16: Claim/service lacks information (something’s missing)

CO-50: Not medically necessary (they disagreed with the diagnosis for the service)

CO-197: Authorization absent (they wanted a pre-approval number)

Think of them as the insurance world’s shorthand for “not like that.”

👉 Each insurer may use its own conventions, but many pull from national standards:

CARC (pronounced “carck”): https://x12.org/codes/claim-adjustment-reason-codes

RARC (pronounced “rarck”): https://x12.org/codes/remittance-advice-remark-codes

Where do I get the details?

In previous blogs, we’ve reviewed getting claim information (detailed service line) and the EOB’s to help identify errors. You’ll need some of the same tools here.

What if I don’t have my EOB or denial letter handy? Good news, there are options for getting the details you need.

Insurance portal: Download EOBs/denial notices from your member portal.

Patient portal: Many providers post billing statements or superbills.

Provider billing office: Ask for claim details and the remittance advice (their version of your EOB).

Insurance member services: They can mail/email the EOB/denial explanation.

It seems backward that you have to chase down paperwork, but knowing what was on the claim that went to the insurance is half the battle.

Step 2: Match the Denial

This is where people may want to throw up their hands. However, if you understand the code, you can take the first step, such as checking your benefits, contacting your provider's billing office, or speaking with your insurance company.

Here’s the good news: once you know why a claim was denied, you can usually match it to the right next step. Sometimes that means reviewing your benefits, sometimes it means calling your provider’s billing office, and sometimes it means asking your insurer for more details.

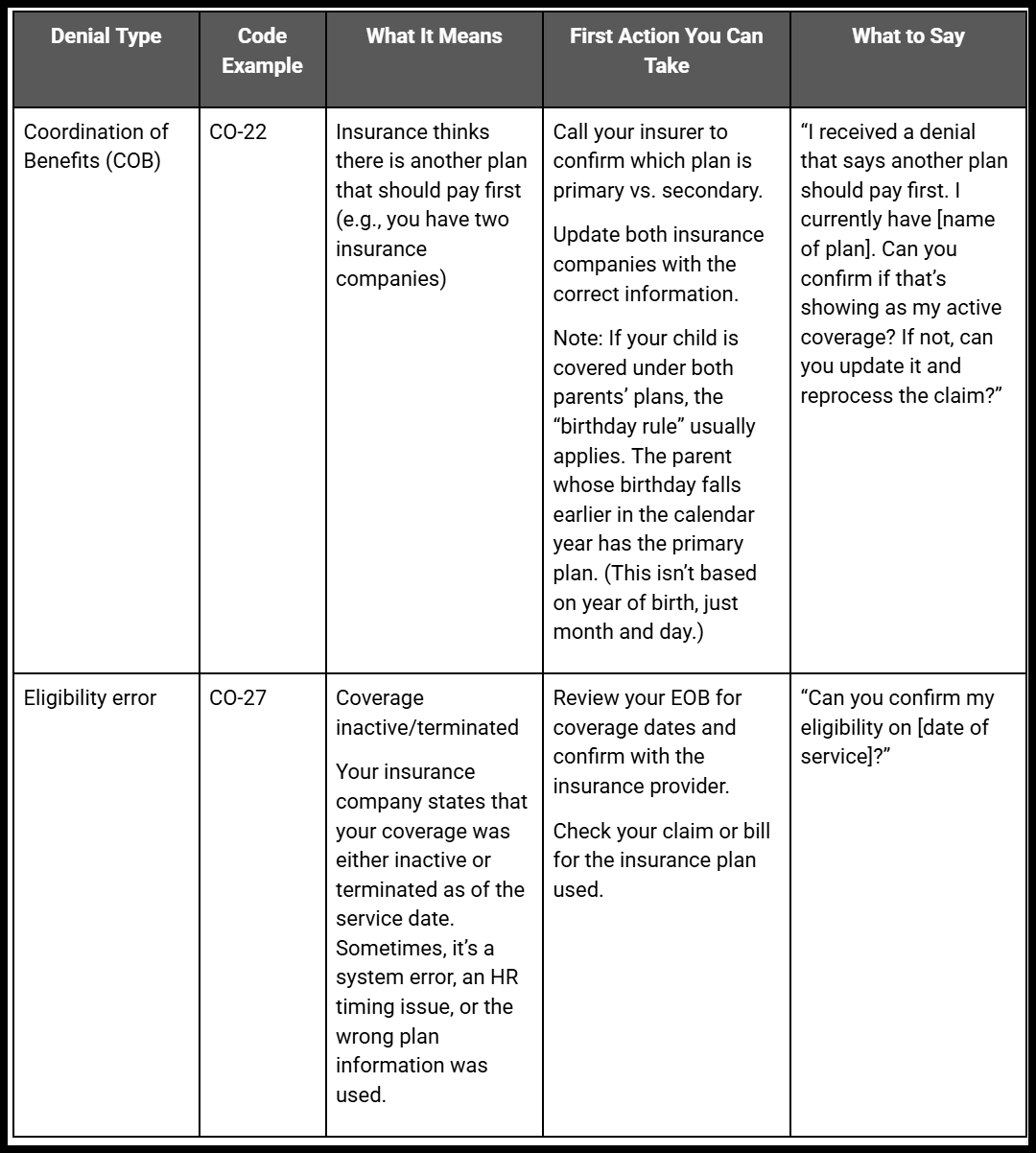

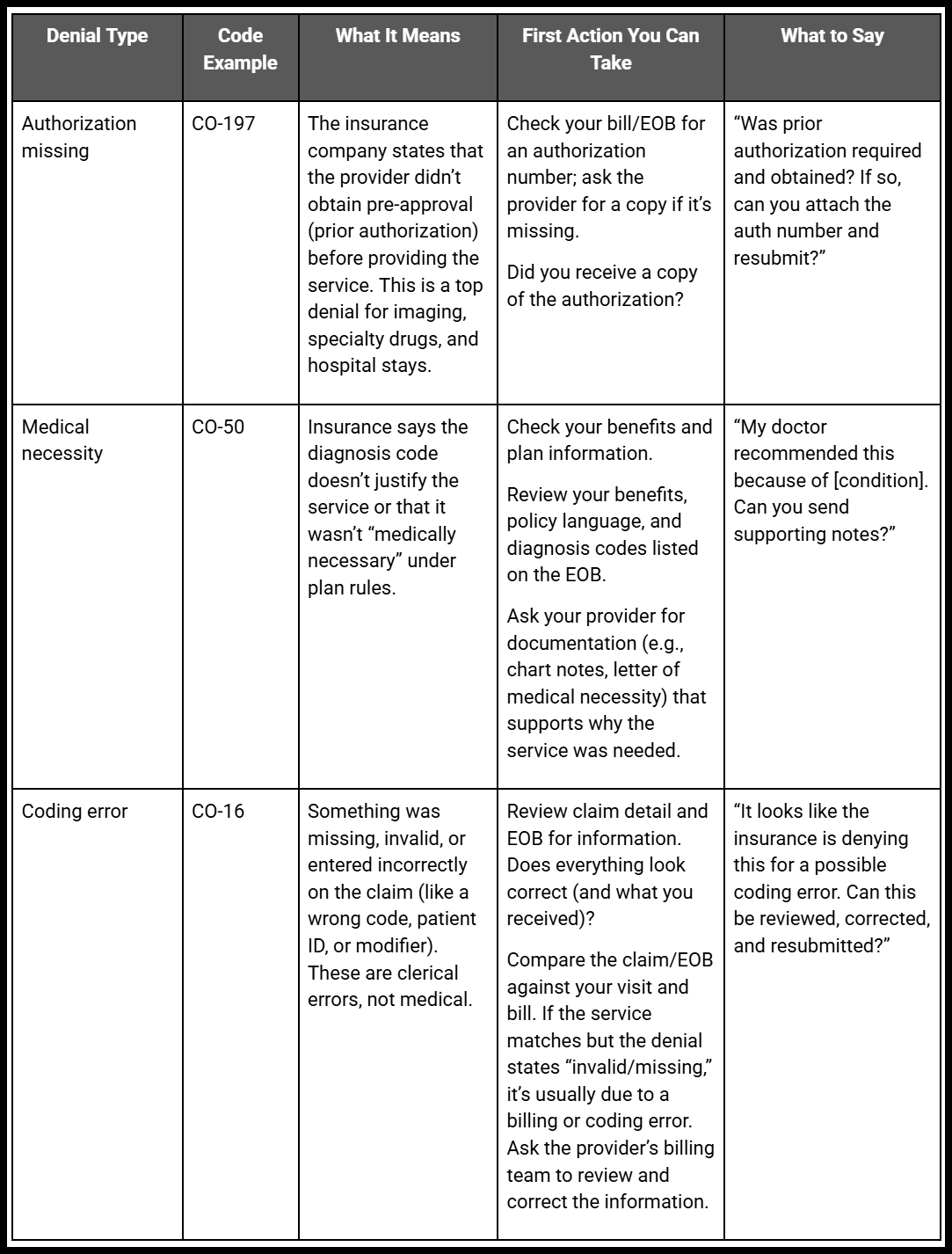

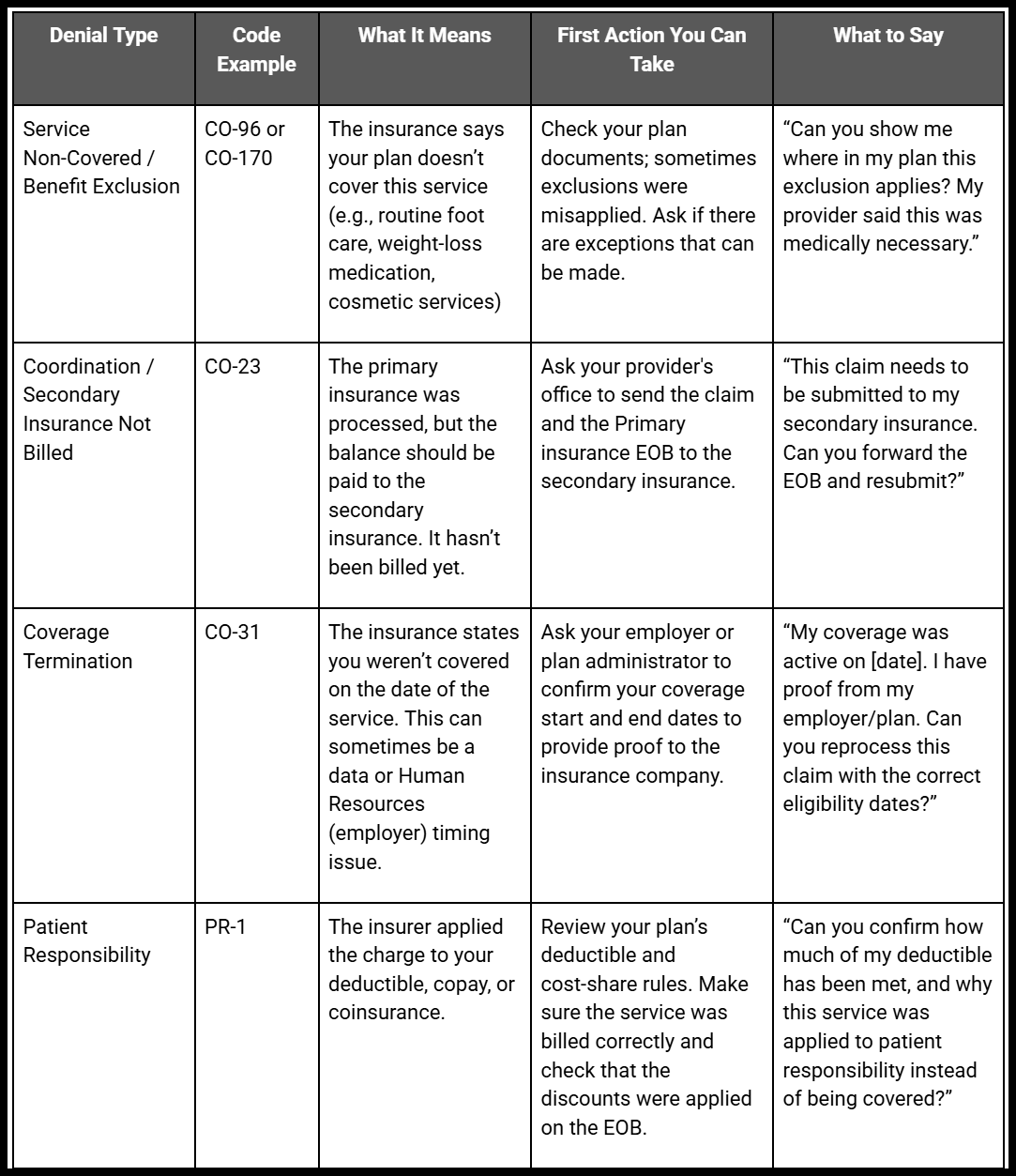

Think of this as your mini playbook:

👋Actual codes on your EOB may be different, but in general, these are common denial reasons.

👋 These examples are intended to make those tough calls easier and provide insight into what you want to say. They’re suggestions, not legal advice; every plan and situation can vary.

💡 Note: You don’t have to do this all alone. Many provider offices are happy to help you through the process, and in some cases, they’ll even handle the appeal for you. What I’m offering here is for people who want to understand more, gather details on their own, or maybe you’re just a lover of puzzles! 🧩

📝 Notes

Birthday rule (COB): If a child has two plans, the parent whose birthday falls earlier in the calendar year is primary (month/day, not year).

Authorization Artifact: If you were told that prior authorization is required, request a copy of the approval that includes the authorization number.

Patient vs. provider responsibility: “Patient responsibility” does not mean “you owe everything.” In-network contracts and policy rules often limit balance billing.

💡 Tips for Gathering Info

EOB: Look for line items marked “patient responsibility” vs. “provider adjustment.” That helps you see whether the denial is something you owe or something the provider may need to fix.

Provider vs. Insurance: Remember, you can request information from both parties. Sometimes, the provider’s office sees details that you don’t, and vice versa.

Step 3: Call Your Provider Billing Office

Once you’ve reviewed your EOB and identified the denial reason, your provider’s billing office is often the next best call. They are the ones who coded and submitted your claim, and in many cases, they can help you file the appeal (or submit the claim again).

Here’s what to ask for when you call:

A copy of the claim and the denial (they receive it as a remittance advice).

Whether the denial can be corrected by resubmitting (for example, by fixing a code, attaching medical records, or including the authorization number).

If they can file the appeal on your behalf, many provider offices will, especially if it’s their coding or paperwork issue.

It can feel awkward to call your doctor’s office about billing, but remember, denials are just as frustrating for them as they are for you. Staff are often stretched thin, but many are glad to help once you give them the details.

Many provider offices also offer portals, where you can message the billing department and attach any available documentation. I have resolved several issues this way, and literally saved tens of thousands of dollars on incorrect bills.

Sometimes, the provider’s office can solve the problem with a quick resubmission or by attaching the missing paperwork. However, if the denial still stands or if you require further clarification, the next step is to contact your insurance company.

Step 4: Call Your Insurance Company

Your insurer’s member services line (the number on the back of your card) can be frustrating to navigate, but it’s often the fastest way to cut through the mystery of a denial.

When you call, ask for:

A plain-English explanation of the denial reason code.

A copy of the policy language used to make the decision (you’re entitled to it).

The exact steps to appeal internally, including deadlines.

Confirmation of what documentation they need (e.g., medical records, prior authorization, corrected claim).

Keep a pen handy! Write down the date, the name of the person you spoke with, and any reference number they give you. This creates a paper trail in case you need to escalate the issue later.

Think of it less like keeping a diary and more like leaving breadcrumbs through a forest, so when you (or the insurer) get lost, you can find your way back.🌲🍞

Step 5: Filing an Appeal with the Insurance

If the provider’s office can’t resolve the issue with a correction or resubmission, and your insurance company confirms the denial stands, the next step is to file an internal appeal (also referred to as a reconsideration).

Think of this as building your “case file.” It may sound intimidating, but it’s really about gathering the necessary documents and presenting them clearly.

What to include in your appeal packet:

✅ A copy of the denial letter or EOB

✅ The denial code and explanation (highlighted or circled for clarity)

✅ Any supporting medical documentation from your provider (notes, test results, letter of medical necessity)

✅ Prior authorization approval (if applicable), get a copy from your provider

✅ Your own appeal letter (briefly explain why the denial should be overturned. “My provider ordered this service for [condition]. The care was medically necessary as deemed by my doctor, and I am requesting reconsideration.”)

How to file:

Most insurers allow appeals to be submitted by mail, fax, or through the member portal.

Follow the directions on your denial letter exactly; appeal addresses and requirements vary.

Mark your calendar for deadlines. Internal appeal windows can range from 30 days to 180 days. Missing the deadline usually means starting over or losing the chance to appeal.

You shouldn’t have to become your own case manager or advocate, but until the system changes, patients who gather these details are often the ones who get results.

Step 6: Filing an Appeal with the Insurance

If your internal appeal to the insurance is still denied, you have another option: external review. This means that an independent medical reviewer (not your insurance company) will review your case.

For commercial plans, this is usually through your state insurance department.

For Medicare, reviews go through the Center for Medicare and Medicaid Services (CMS)

Timelines and processes vary, but most states require insurance companies to inform you of the process for requesting this in your denial letter.

Think of this as your second opinion, but from a regulatory perspective.

Tips For Patients

Of course, you shouldn’t have to be a policy detective just to get care. But when you do have the chance, being proactive makes denials less likely and puts you one step ahead.

Be proactive when possible. Emergencies are different, but for planned visits or procedures, it's best to check your coverage in advance. Know if prior authorization is required or if certain providers are out-of-network. It won’t prevent every denial, but it can save you from surprises.

Use your portals. Sign up for your insurance member portal and your patient portal through your provider. These are excellent tools and contain a wealth of information.

Know your coverage. Review your plan documents or call your insurer before a visit. This can help you spot services that may need prior authorization or aren’t covered under your plan.

Don’t stop at “we don’t know.” If your provider can’t confirm, call your insurance member services. Ask directly: “Are there exceptions or exclusions for this service?”

Keep a paper trail. Write down dates, names, and reference numbers every time you talk to your insurer or provider. Save your EOBs and letters. Appeals often come down to proving who said what, when.

Watch the clock. Appeals have deadlines (anywhere from 30–180 days). Mark them on your calendar so you don’t miss your window.

Remember: A denial isn’t always the final word. More than half of the appealed denials get overturned; persistence pays off.

Sometimes you’re the detective, gathering the evidence. Other times it feels like herding cats 🐈. But it’s possible to make progress with the right strategy and tools.

Tips For Teams

Design with clarity. Don’t just display “Denied.” Pair the denial code with a clear, plain-English explanation and outline the next steps to take. Example: “CO-197: Authorization missing. Ask your provider’s office if prior approval was obtained.”

Make EOBs and portals usable. Patients shouldn’t need a coding degree to figure out what happened. Use design elements (icons, highlights, tooltips) to separate “what insurance paid,” “what the provider adjusted,” and “what the patient might owe.”

Build in education. Add links to FAQs, appeal instructions, or even example scripts patients can use when calling their insurer or provider. A little guidance reduces panic and call volume.

Track patterns. Analyze denial data by payer, service, and provider. Build dashboards for the top 10 denial reasons and create automated alerts or edits to prevent them at the front end.

Bridge the language gap. Providers, payers, and patients often use different terms for the same issue. Build systems that translate code into consistent, human-readable language.

Prevent the preventable. Up to 80–90% of denials are avoidable through improved intake, eligibility verification, coding, and documentation. Focus your technology and process fixes on these areas first.

Empower providers. Provide provider portals with tools to view denial reasons in real-time, attach missing documents, and resubmit electronically without the need for weeks of phone calls.

Test with real users. Present prototypes to patients and billing staff. If they can’t quickly understand what a denial means in your system, keep iterating.

The more your systems translate denials into clarity, the less patients and providers feel like they’re fighting alone.

Wrap Up

Appealing a denial isn’t easy, and it doesn’t always feel fair. However, patients, providers, and teams have more power than it may seem.

Sometimes you’re the detective, following the trail of codes, coverage rules, and paperwork until the missing piece shows up. Other times, you’re the whisperer, using the right words to get the system to listen.

The good news is that more than half of the appealed denials are overturned. Persistence pays off.

Whether you’re solving the puzzle or guiding the process, remember: denied doesn’t always mean denied forever.

Thanks for reading,

Bonnie

📚 Missed the earlier posts in this series?

Catch up here: https://coviewconsulting.substack.com/

Why I Started CoView: Navigating Both Sides of Healthcare

Speaking the Same Language in Healthcare

Meet the Players: Patient, Provider, Payer

Cracking the Code

Your Claims Post Visit Adventure

This is Not A Bill? Reading your EOB

Who Pays For What? Part 1: Medicare & Medicaid

Choose Your Own Adventure: Commercial Insurance Explained

Copay, Coinsurance, Deductible Oh My!

No Soup For You! Claim Denials Explained

What’s Next: EPO, PPO, HMO, HDHP - the worst Scrabble tiles ever

EPO, PPO, HMO, HDHP, whew! It looks like you’ve just drawn the worst rack of Scrabble tiles.

But behind those letters are differences in how your care is covered, who you can see, and how much you’ll pay.

In my next blog, we’ll break down these plan types in plain English: what they mean, how they affect your wallet, and how to choose (or use) them with the decoder ring you’ve never known you needed.

💡 If this post helped clarify your coverage chaos, share it with a friend or colleague! And if you have questions or want to see a specific topic covered, drop me a line. I’d love to hear from you.

Note from the Author: This blog is for educational purposes only and reflects my experience. This is not intended as legal, financial, or medical advice, nor is it a preparation for any medical coding exam. Always confirm details with your insurance company, healthcare provider, or HR department. It’s designed to help cross-functional teams in the healthcare industry work together more effectively, and to help you feel more confident advocating for yourself and your loved ones in your personal healthcare matters.